2021 ICSC & NAIOP Reports Show Improvement in Retail and Office Sectors

By Natalie Jones / 07.30.21 / 3 min read

In the midst of bouncing back from economic difficulties, the commercial real estate industry receives promising news via reports from two renowned organizations. Check out some of the key findings for the retail and office sectors!

The International Council of Shopping Centers (ICSC), a group with over 70,000 members across the world that specializes in growing retail spaces, published a report for Q1 2021 about shopping center activity. According to ICSC, 52% of surveyed consumers plan to reduce online orders, the net operating income decline is less sharp compared to last year, and there are noticeable difference in areas including rent collection and consumer engagement.

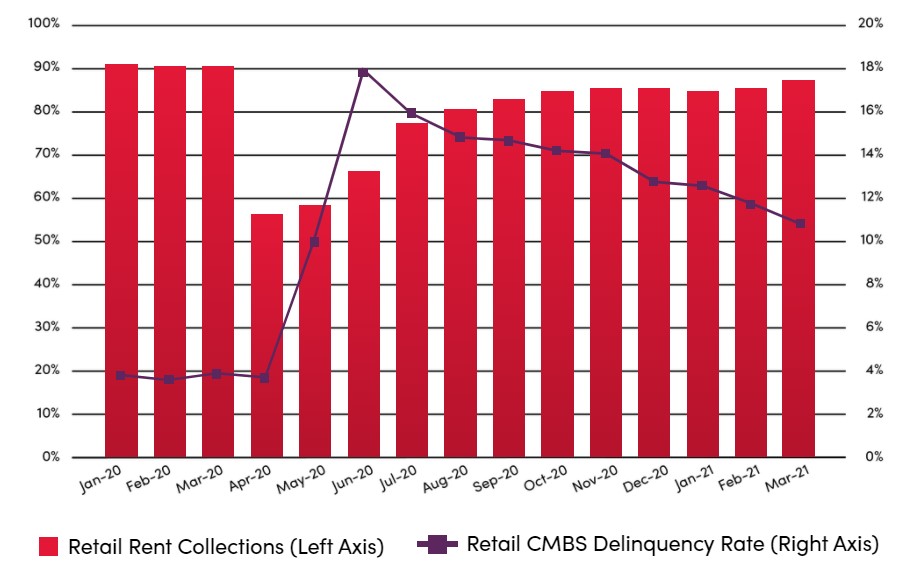

Rent Collection and Delinquency Rates

When retail rent collection rates dropped during April and May of last year, the delinquency rate increased, reaching 18% in June of 2020. However, as seen in the graph below, both rates have improved in the opposite direction over several months.

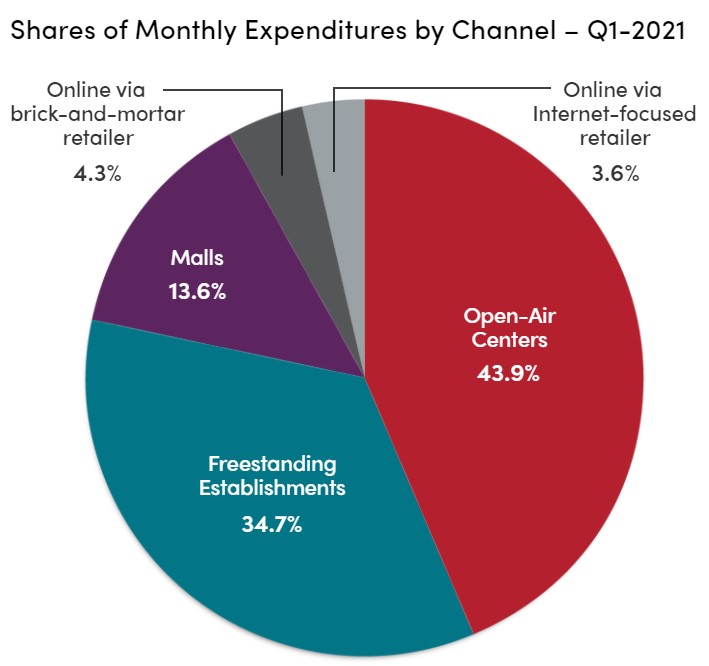

Consumer Engagement

Consumers have spent less money at malls and online retailers and more at free-standing establishments as well as open-air centers in the Q1 2021 data set. These findings are compared to Q4 of 2020 where holiday shopping played a significant role in where consumers spent their money.

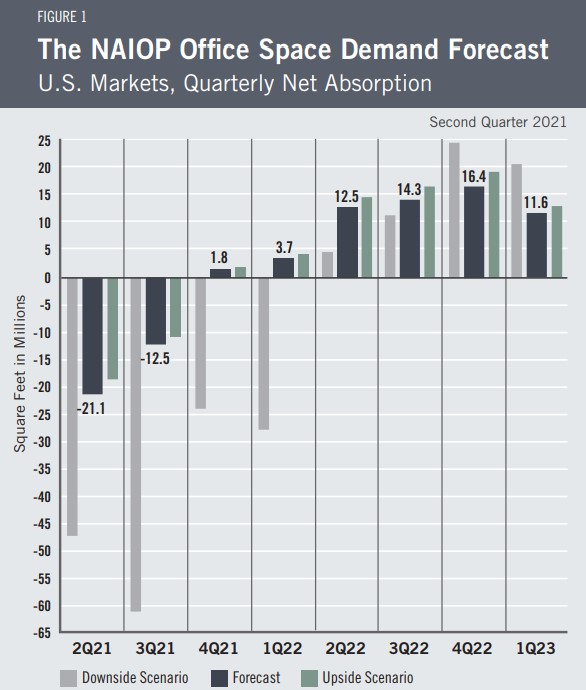

NAOIP, the Commercial Real Estate Development Association, states that office absorption is projected to stabilize by half-way through 2022. Consecutive checkpoints with negative net absorption in Q4 of 2020 (-26.7 million square feet) and Q1 of 2021 (-34.8 million square feet) are expected to discontinue with the prediction of a positive figure in Q4 of 2021 as safety issues decline and the economy moves deeper into recovery.

Experts say that 2022 will see a net absorption averaging 11.7 million square feet per quarter which is consistent with the quarterly average from 2015 to 2019. The figure below illustrates the anticipated net absorption until 2023.

We look forward to keeping you updated on the latest commercial real estate data from professionals in the industry. To read our sources, click below: